Chrome markets and resources

The vast majority of chrome ore (Cr ore) produced worldwide is metallurgical grade ore. This ore in the main is used to produce ferrochrome (FeCr) which itself is a key ingredient in the production of stainless steel. The stainless steel industry is the major driver of the chromium industry.

Market overview

South Africa, holds the largest global resources and reserves of Cr ore and as such is the world leading producer and exporter of Cr ore. The country’s abundance of resources and the production of some Cr concentrates, as a by-product to Platinum Group Metals production, has made it a leading producer. Despite systemic power supply, logistics and social issues, South Africa remains the largest FeCr producer outside China.

In 2012, driven by its rising stainless steel industry, China became the biggest FeCr producer worldwide overtaking South Africa. China holds virtually no resources and reserves of Cr ore. Its FeCr industry is reliant on imported material, mainly from South Africa, making it, the biggest Cr ore importer in the world.

Whilst South Africa and China are the driving forces behind the chromium market, there are other important actors in play (Kazakhstan, India, Turkey, Zimbabwe, Finland, Sweden, Albania, Oman Sultanate to name but a few). In some cases, these countries have positioned themselves on niche products including high-grade ores, chemicals, foundry sands, chrome metal and specialty FeCr grades aimed at market segments with specific requirements.

Market analysis

ICDA produces regular market analysis reports. Members receive a weekly newsletter service covering latest market trends worldwide and in China.

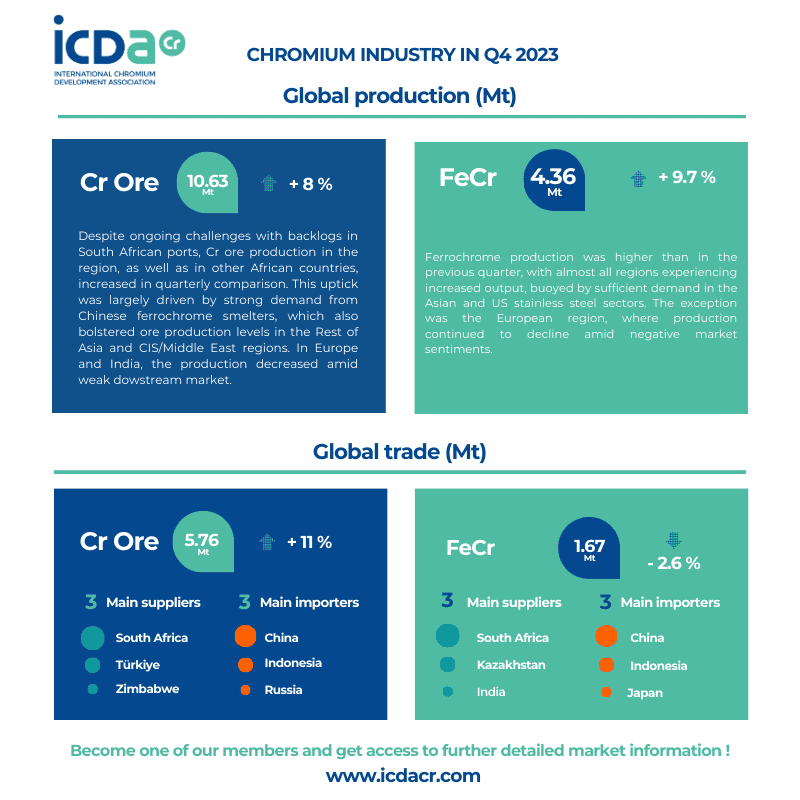

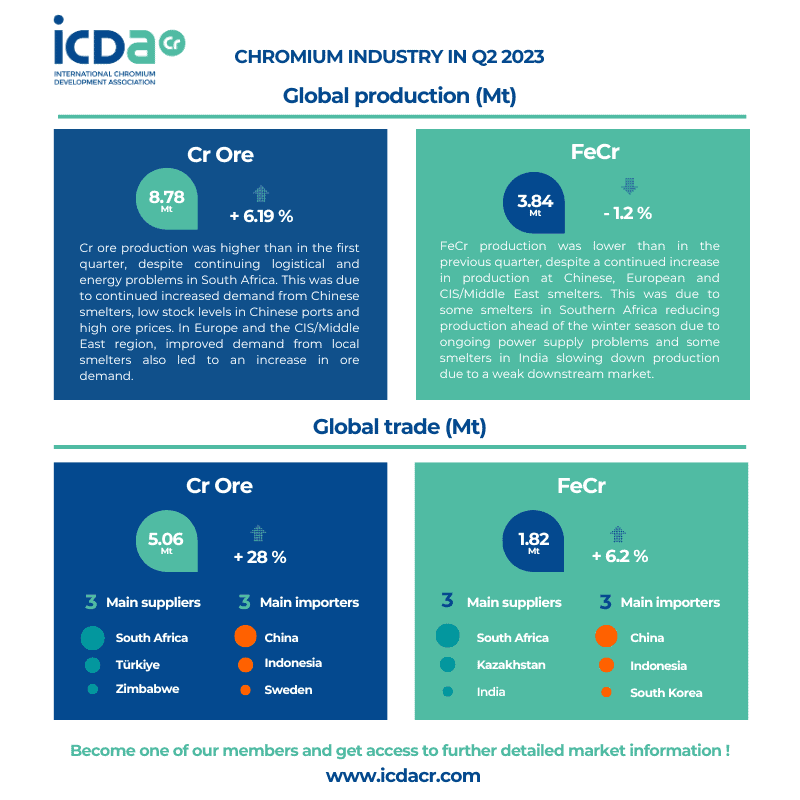

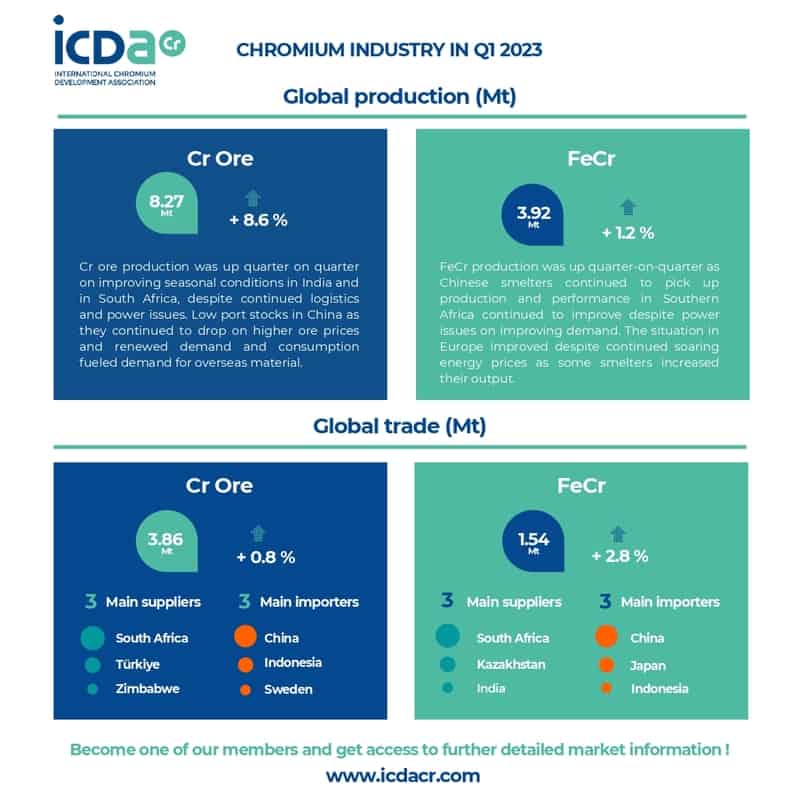

Discover further details on the chromium market in our quarterly market analysis infographics below.

Join Us

For all the latest market data, regular market analysis and market research on the global chrome and ferrochromium markets, become an ICDA Member.

Chromite resources

Global distribution of chromite resources by country

South Africa is home to most of the global chromite resources. However, chromite is found in many countries including Zimbabwe and Kazakhstan, which also have significant resources.

Chromite resources by country

Chrome ore resources, reserves and production in 2023

> 12000 M

Resources

> 470 M

Reserves

> 39 M

Production

Chrome ore production

Chrome ore producers

While South Africa is by far the largest producer of chrome ore, production takes place all over the world.

Chrome ore world production in 2023

Mt

%

25846 Kt

South Africa

+ 7 %

4886 Kt

CIS & Middle East

– 2 %

3333 Kt

India

– 8%

2939 Kt

Western Europe, Albania, Türkiye

– 8%

1918 Kt

Rest of Africa, Americas

+ 10%

740 Kt

Rest of Asia, Australasia

+ 34%

Calculation based on industry data supplied to the ICDA, official trade data and data from regional organisations.

Global chrome ore and UG2 production

Companies in South Africa also supply chrome ore as UG2 (Upper Group 2 reef), during the production of Platinum Group Metals (PGMs). The supply of UG2, in addition to traditionally mined chrome ore, has changed the structure of the ferrochrome industry. More information on UG2 is available on our chrome ore page.

Chrome ore and UG2 production in 2023

Ferrochrome production

Ferrochrome production by country

China is the leading producer of ferrochromium, followed by South Africa, Kazakhstan and India. Other producing countries include Albania, Brazil, Finland, Germany, Indonesia, Japan, Oman Sultanate, Russia, Sweden, Turkey and Zimbabwe.

Ferrochrome world production in 2023

Mt

%

15348 Kt

31 Kt

828 Kt

Charge Cr (HC)

Medium carbon

Low carbon

+ 4 %

+ 20 %

– 1 %

7920 Kt

China

+ 13 %

3899 Kt

South Africa & Zimbabwe

– 9 %

1686 Kt

CIS & Middle East

– 7 %

1545 Kt

India

+ 20 %

598 Kt

Western Europe, Albania, Türkiye

– 22 %

560 Kt

Americas, Indonesia & Rest of Asia

+ 29 %

Calculation based on industry data supplied to the ICDA, official trade data and data from regional organisations.